29+ How much home loan can i take

Of course you dont have to follow it exactly but its a nice guide to. Ad More Veterans Than Ever are Buying with 0 Down.

Making The Buying Leap Kb Homes Home Buying Process Buying A New Home

Its A Match Made In Heaven.

. Apply Get Fast Pre Approval. Ad Looking For A Mortgage. The maximum amount you can borrow with a home equity loan depends on how much equity you have in your property.

The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow. Ad Find The Best Home Equity Mortgage Companies. Let us assume 40 for simplicity.

So in the example above youd be. Todays 10 Best Home Equity Loan Rates. Fill in the entry fields.

For a given EMI that you can afford rate of interest and loan tenure you can determine how much loan you can afford using our Loan Calculator. You can borrow up to the greater of 10000 or 50 of your vested account balance up to 50000. Ad Find The Best Home Equity Rates.

Ad Work with One of Our Specialists to Save You More Money Today. Get Your Estimate Today. Were Americas 1 Online Lender.

So if your net monthly salary is 40000 you can get a home. Lock In Your Low Rate Now. Compare Top Home Equity Loans Save Today.

Most home loans require a down payment of at least 3. This mortgage calculator will show how much you can afford. Assuming you have no other financial liabilities the maximum amount you can pay every.

Its A Match Made In Heaven. Get The Service You Deserve With The Mortgage Lender You Trust. Ad Looking For A Mortgage.

Your maximum home loan amount is. 2941 Rule A good rule of thumb when thinking about how much house can I afford is the 2941 rule. Calculate what you can afford and more.

FHA loans for example have maximum loan limits you cant exceed. For example if you have 45000 in your 401 k you can borrow up to 22500. Estimate Your Monthly Payment Today.

Calculation of MSR is based on loan amount and combined monthly gross income. The current average 10-year HELOC rate is 616 but within the last 52 weeks its gone as low as 255. 25000 you can avail as.

Is It Possible to Increase Your Home. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a. Were Americas 1 Online Lender.

435 27 votes A person who makes 50000 a year might be able to afford a house worth anywhere from 180000 to nearly 300000. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Reputable and Trusted Lenders.

For a 30-year-old individual who has a net adjusted monthly income of Rs50000 with other EMIs of Rs5000 making a down payment of Rs1 lakh if the rate of interest is 8 pa. Get Your Estimate Today. Get The Service You Deserve With The Mortgage Lender You Trust.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Get The Cash You Need To Pay For Whats Important. Thats because salary isnt.

You are eligible for a home loan up to 60 times of your net salary or monthly income. Top Lenders Reviewed By Industry Experts. 55000 you will be eligible for a loan of.

As a rule of thumb lenders will generally allow you to borrow up to 75-90 percent of your available equity depending on the lender and your credit and income. You can usually borrow as much as 80 or 85 of your. For instance if your net salary is Rs.

How Much Mortgage Can I Afford. So if you earn. In this case you need to pay the developer 10 towards the down payment.

Ad Home Improvements College Tuition Or Debt Consolidation - A Cash-Out Refinance Can Help. As a rule of thumb salaried individuals are eligible to get home loans approximately up to 60 times their net monthly income. Ad Reviews Trusted by 45000000.

In such a scenario an applicants home loan eligibility is estimated at around Rs 51250 x 60 max FOIR Rs 3075000. Department of Housing and Urban. The first step in buying a house is determining your budget.

MSR is capped at 30 of all borrowers gross monthly income. Now generally lenders have this rule that says that you should only be using about 30-40 of your income for loan repayments. 15 hours agoTypically HELOC rates move in step with rate increases by the Fed.

For instance if your take-home salary is Rs. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

This year the FHAs national loan limit floor is 420680 the US.

Real Pay Stub

Pin On Hajj Creations

How To Write A Confirmation Letter An Easy Way To Start Is To Download This Sample Audit Confirmation Confirmation Letter Financial Statement Letter Templates

Cozy Minimalist Modern Living Room Brightlivingroom Livingroomdecor Minimalis Bright Living Room Small Living Room Decor Small Modern Living Room

1

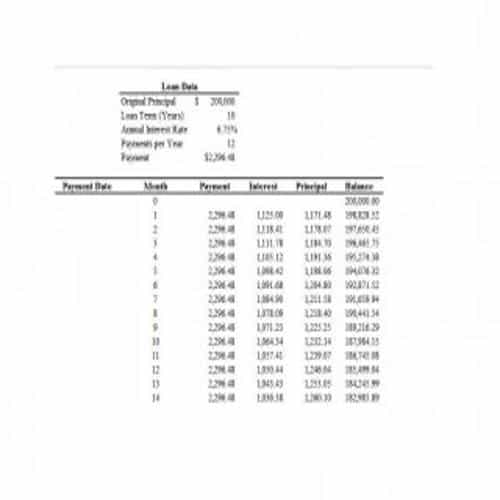

29 Editable Loan Amortization Schedule Templates Besty Templates

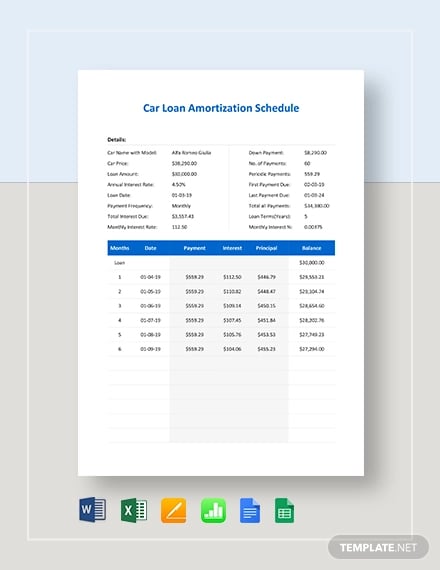

29 Amortization Schedule Templates Free Premium Templates

Pressure Washing Business Startup Cost Infographic Pressure Washing Business Pressure Washing Pressure Washer Tips

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

29 Free Payroll Templates Payroll Template Payroll Checks Invoice Template

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

Tumblr Letter Templates Lettering Payoff Letter

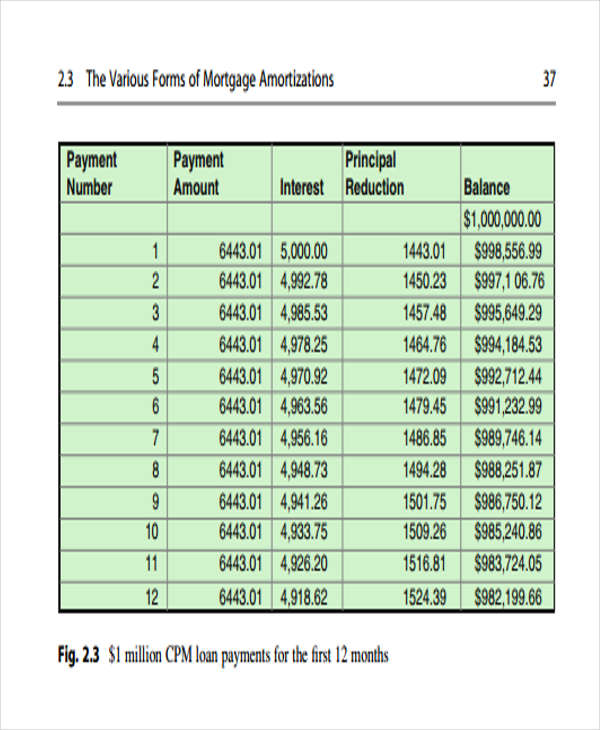

Real Estate Amortization Table

29 Amortization Schedule Templates Free Premium Templates

1

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates